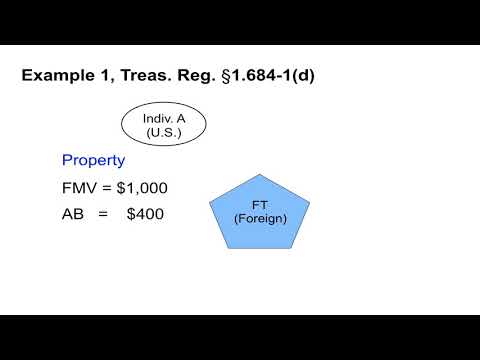

Under Section 684, gain is recognized on transfers of property by US persons to foreign trusts or estates, except as provided in the regulations. - Example 1 of regulation 1.684-1(d) illustrates this rule. - Individual A is a U.S. person. - A owns property that has a fair market value of $1000 and an adjusted basis of $400. - FT is a foreign trust. - FT has no U.S. beneficiaries and no person is treated as owning any portion of FT under the grantor trust rules. - A transfers the property to FT. - A must recognize gain at the time of the transfer, equal to $600.

Award-winning PDF software

Video instructions and help with filling out and completing Are Form 3520 Transfers