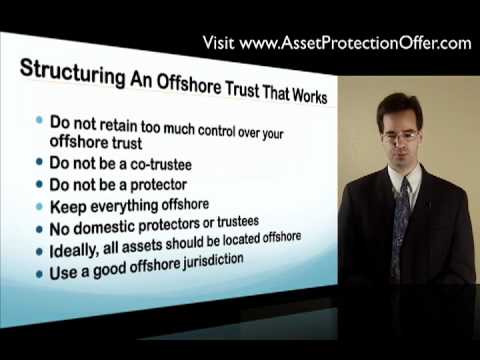

In this video on offshore trust, Ryan explains how to structure a trust. A little bit about myself, I'm an asset protection estate planning and global investment consultant. I have a nationwide clientele with a net worth ranging from about $200,000 to over $100 million. I am the author or co-author of two books on asset protection. The latest book, "Asset Protection and Financially Unsafe Times," co-authored with Dr. Arnold Holt, is highly rated and one of the best-selling books of its type on .com. There are certain guidelines to follow when setting up a trust. First, it is important not to retain too much control. Do not be a co-trustee or protector. As someone who advises, make sure that the trustee fulfills their responsibilities and has the power to veto trustee actions. In some cases, it is advisable to keep everything offshore for the best protection. However, there may be exceptions, which will be discussed shortly. If there are no immediate threats from creditors, it can be an acceptable compromise to keep assets in the US as long as they are held by an offshore trust. It is strongly recommended to set up a foreign trading account that purchases US documents to maintain some offshore presence. Ideally, at least half of the assets should be kept offshore. If this is not possible, it is recommended to place assets and investments, such as real estate, into an LLC or limited partnership. LLCs and limited partnerships provide some asset protection under US law, but it is important to note that they are still subject to a judge's decision. To ensure maximum protection, these entities should be owned by an offshore trust. In a worst-case scenario, the offshore trust can dissolve the LLCs and limited partnerships, and move the assets offshore. It is also...

Award-winning PDF software

Video instructions and help with filling out and completing Can Form 3520 Beneficiary