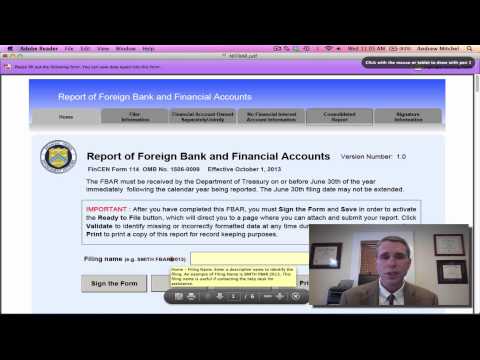

Hi, I'm Andrew Mitchell. Today, we're going to talk about the F bar, or the Foreign Bank Account Report. The F bar had an update this year. It's now changed its name. It used to be called form TD f 90-22.1. Now it's FinCEN form 114. One of the major changes is that the form must be electronically filed. You used to file it by paper, but now it's filed electronically through the FinCEN website. The purpose of the F bar is to file information about US citizens and US individuals that have foreign bank accounts, foreign brokerage accounts, mutual funds, foreign insurance policies, and new 'ti policies. It's kind of unclear sometimes if foreign pensions should be included or not. If it were a pension similar to a 401k or an IRA, it's a foreign comparable to one of those two, I would go ahead and include those types of accounts on the F bar. So, in order to get to the F bar, if you go to the FinCEN form 114 and search for it, you'll come up with search results and you want the search result that says "File Individual F bar FinCEN form 114". If you click on the first link, it'll get you there, but it's a little bit convoluted. So, you really want to file an individual F bar. This brings you to a screen with two steps. First, you download the individual F bar and then you fill it out. The second step is to file the form where you upload it to the FinCEN's website. You can file the form jointly with your spouse if you have your spouse fill out form 114a. There are line-by-line instructions on the side. They used to be three pages long, but now they're up to 19 pages. Granted,...

Award-winning PDF software

Video instructions and help with filling out and completing Can Form 3520 Willful