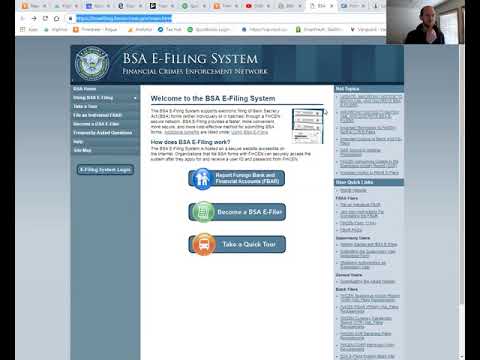

Just about to your old age and owner wrote as professionals wanted to remind my clients and other businesses that are in cash intensive businesses to file their 80 form 8300. That is a form in which if you one of your customers pays you an accumulated amount over $10,000, you need to file this form. It is a misperception that if you were to pay nine thousands of nine thousand dollars, you would avoid getting reported. But that's not the case, the IRS requires this form when there's an accumulated total over ten thousand. So, you should probably be collecting the information to fill this form out as soon as you start receiving cash and expect to receive over ten thousand. The form looks like this form 8300. You got to put the information from the person dropping off the cash. You've got to put down the information of the company that is you're receiving the cash from. You got to put your information in and you've got to put in the details of how that money was received. So, it's a big ordeal but what can make it simpler is that you can do these online. You've got to become a BSA e-file, so if you go to and you do BSA fee filing system, you can start filling these out. From what I understand, there is like, you know, it will track what you have entered before so you can easily update the accounts of the people who are dropping cash off. At least from what I understand, I personally haven't filed any myself. I rarely, I don't receive over $10,000 from any one client in cash, typically be nice but I don't. And so, I'm just letting you know that these are the things that you need...

Award-winning PDF software

Video instructions and help with filling out and completing Fill Form 3520 Iii