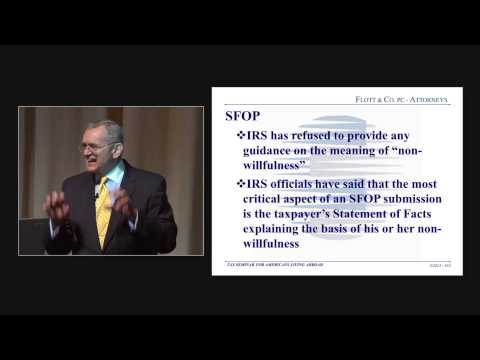

Now, all that I said before, the lack of a statute of limitations on an unfair attorney, and the penalties applied to unfiled bars after several years of advocacy by us and others with the IRS, beginning in March 2009, we finally, finally persuaded the IRS to adopt a program far more open to innocent non-filing. So what we've said to the service for, since against since March of 2009, is that there are hundreds of thousands, if not millions, of US citizens living around the world who have no idea of this obligation to file this foreign bank account report. They live in a foreign country, they have their bank accounts in a foreign country, isn't that a big surprise? And effectively, they pay tax in a foreign country. Most of them don't know they have to file US tax returns, and they sure don't know anything about these foreign bank account reports because they don't consider their bank accounts foreign. And finally, in June last year, June 18th, 2014, the service adopted the streamline foreign offshore procedures (SFO p for short), and I have to say it's a reasonably good program. I have some problems with it still, and I've hassled the service about them, but it generally it's a very good program because it really is an amnesty, which I'll talk about in a minute. It requires that you be a resident outside the United States for at least one year during the last three filing seasons. So if you were to file in 2015, you would have had to have been out of the United States for at least one year during the tax years 2011, 2012, and 2013. It eliminates all tax penalties and all f bar penalties. It requires only the payment of tax...

Award-winning PDF software

Video instructions and help with filling out and completing Form 3520 Streamlined