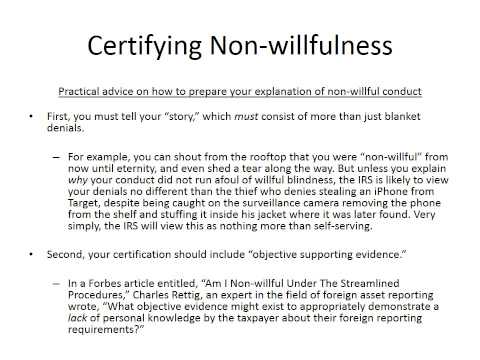

Hey everyone, it's Bliss here. Welcome back to the webinar on demystifying the FBAR. We're now up to module 6, certifying non-willfulness. When I talk about certifying non-willfulness, I'm referring to certifying it for the purposes of the streamlined procedures. As many of you know, one of the most critical requirements of the streamlined procedures is that the taxpayer certifies that their failure to report the foreign account was non-willful. The problem is that there isn't much guidance on what the textbook definition of non-willfulness is. The IRS should have provided taxpayers with a clear definition of willfulness and then given examples of non-willfulness. Instead, we're left with this vague term that is the centerpiece of making a streamlined submission, whether it's domestic or foreign. So how do we deal with this nebulous term that could mean the difference between acceptance or rejection of our certification on a streamlined submission? The best explanation I've seen of willfulness is from Jack Townsend, the author of the popular tax crimes blog. He describes willfulness and non-willfulness as lying on a continuum, like an electromagnetic spectrum. Now, visualize an electromagnetic spectrum and focus on the two extreme ends. On one extreme, we have short wavelength radiation, such as gamma rays. On the other extreme, we have long wavelength radiation, like radio waves. To simplify, let's substitute "not willful" for the short wavelength pole and "definite willfulness" for the long wavelength pole. In some cases, the facts will clearly fall on one extreme end of the spectrum, making it easy to determine if the conduct is willful or non-willful. For example, if a taxpayer's conduct falls on the definite willfulness end of the spectrum, they should apply to the offshore voluntary disclosure program without hesitation. On the other hand, if a taxpayer falls on...

Award-winning PDF software

Video instructions and help with filling out and completing What Form 3520 Streamlined