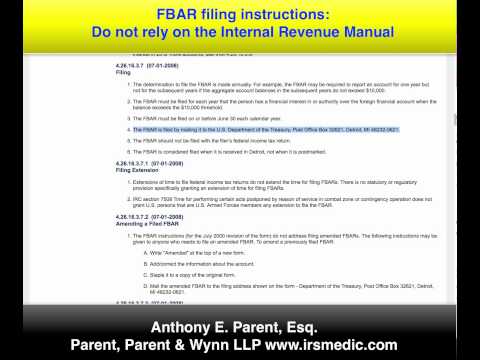

Hi, Anthony here. I want to show you a mistake the IRS makes with F bars. The IRS is new to administering your F bar, and we can easily find a mistake. The instructions in the Internal Revenue Manual differ from what is actually required in real life. I have looked into the Internal Vibranium Annual and found a section on the F bar filing criteria. Let's find where to file an F bar. Ah, here it is, number seven. According to the IRM, the F bar should be mailed to the US Treasury Department of the Treasury Post Office 3 to 6 21 Detroit Michigan. Now, let's search to see if that is really required. I found a search result on the IRS website, which seems like a good place to go. It mentions filing options, including e-filing and filing by paper. Financial Crimes Enforcement Network is also mentioned. On September 30th, 2013, FinCEN posted a notice on their website announcing the current F bar form, which is only available online through the BSA E-Filing System. This is a perfect example of the IRS not being aware of its own rules and getting it wrong. You cannot file an F bar by mailing it to the US Department of Treasury P.O. 32621. As a webmaster, I should correct the misinformation. This is Anthony Parent of Parent & Parent LLP, the IRS medic, and I hope you found this video informative. Thanks for watching.

Award-winning PDF software

Video instructions and help with filling out and completing Why Form 3520 Imposed