Okay, we're back and we're going to talk about some of the fancier stuff in international tax. We're not going to cover all of the slides. I distributed about 20 of them. We're just going to talk about selected pieces. We should be able to finish up by 7:45 on this segment. I haven't heard back from you on preferences, so I'm going to focus heavily on check-the- rules. But first, let's talk about mixer companies. Mixer companies are a term that has been around for the entirety of my career. The concept is that you have a subsidiary that holds various joint venture companies or checked entities in different countries that have differing tax rates. The idea is to get your tax rate in the mixer company to something that, when it pays dividends, you can use the credits and possibly avoid some of subpart F if the companies have high enough tax rates. The term mixer company is simply a company that is used to blend tax rates. There's no particular magic to setting it up or doing anything with it. This is just a definition of a term that you may hear talked about. The tax rate of the mixer company is the blend of the tax rates of the various subsidiaries. Now, let's talk about check-the- rules. We are all familiar with us LLC's. A single member LLC is disregarded as separate from its owner and a multiple member LLC is treated as a partnership unless we elect something else. Well, this is under the check-the- rules. First, a little bit of history. Back in the 80s and 90s, before the check-the- rules came about, I was regularly doing the same thing without them. It took a little more work, and we charged a higher fee. I...

Award-winning PDF software

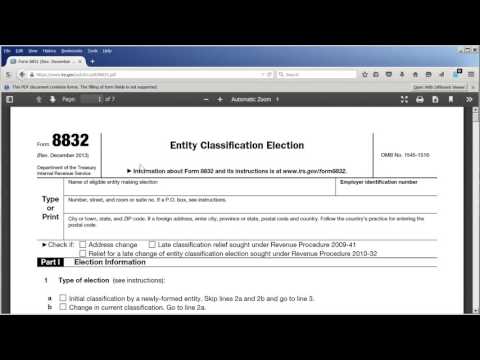

Video instructions and help with filling out and completing Will Form 3520 Credits